Cash flow management is one of the most critical aspects of construction project management. Proper cash flow tracking ensures that funds are available for critical activities while preventing financial bottlenecks. Leveraging Excel for cash flow management is a cost-effective and efficient way to plan, monitor, and analyze the movement of cash throughout a project’s lifecycle.

This guide introduces the concept of cash flow in construction projects, highlights the importance of effective tracking, and dives into two essential resources: Shrief Elgendy’s YouTube video tutorials on cash flow in Excel. These videos provide practical, hands-on guidance to streamline your cash flow management process.

Table of Contents

What Is Cash Flow in Construction Projects?

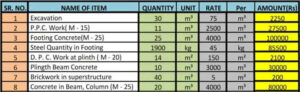

Cash flow in construction refers to the inflow and outflow of money over the course of a project. It includes:

- Inflow: Payments received from clients for project milestones, claims, or invoices.

- Outflow: Payments made to suppliers, subcontractors, and laborers, as well as overhead costs.

A positive cash flow ensures that a project has sufficient funds to continue operations, while a negative cash flow could lead to delays or even project failure.

Why Use Excel for Cash Flow Management?

Excel is a versatile tool for managing construction project cash flow because:

- Customizability: You can tailor your spreadsheets to meet specific project requirements.

- Accessibility: Excel is widely used and requires minimal investment compared to specialized software.

- Analysis Tools: Features like charts, pivot tables, and formulas make it easier to analyze trends and forecast cash flow.

Cash Flow Concepts Explained in the Videos

Let’s dive into the two YouTube tutorials by Shrief Elgendy that showcase practical approaches to managing construction project cash flow in Excel.

Video 1:

In this video, Shrief Elgendy provides a detailed walkthrough on building a cash flow forecasting sheet in Excel. Key takeaways include:

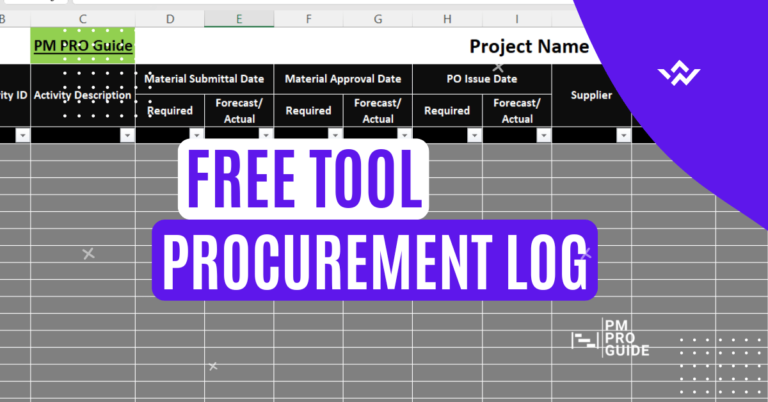

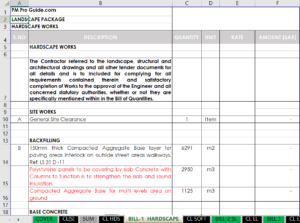

- Creating a Cash Flow Template

- Learn how to set up a structured table to track income and expenses by project timeline (e.g., weekly or monthly).

- Organize columns for revenue, expenses, cumulative totals, and net cash flow.

- Using Formulas for Automation

- Implement Excel formulas such as

SUM,IF, andOFFSETto calculate totals and forecast cash flow over time. - Shrief emphasizes automating repetitive calculations to save time and reduce errors.

- Implement Excel formulas such as

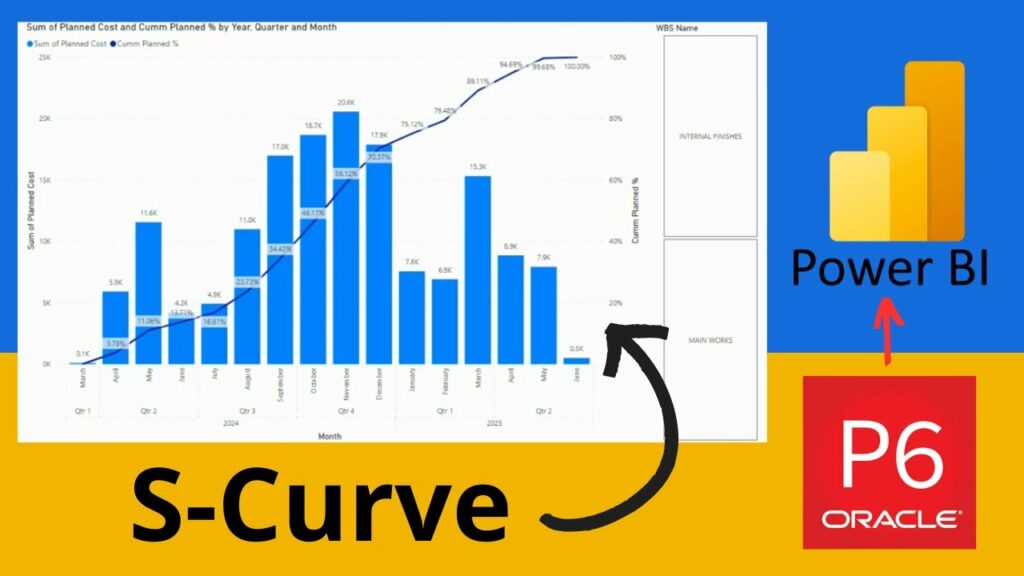

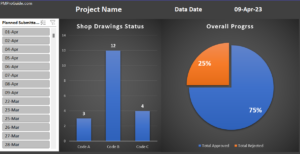

- Visualizing Cash Flow Trends

- Utilize Excel’s charting tools to create a cash flow curve, which helps in identifying periods of surplus or deficit.

- A cash flow S-curve is explained to represent project progress visually.

Video 2: Advanced Cash Flow Analysis in Excel

In this advanced tutorial, Shrief Elgendy explores how to refine your cash flow management process with additional Excel functionalities:

- Dynamic Cash Flow Tracking

- Use dynamic formulas and named ranges to make your cash flow sheet adaptable for different project scenarios.

- Learn how to integrate multiple cash flow components (e.g., material costs, labor expenses) into a unified view.

- Scenario Analysis

- Shrief demonstrates how to simulate different cash flow scenarios using Excel’s

Data TableandGoal Seektools. - This approach allows project managers to plan for contingencies, such as delays in payment or unexpected cost increases.

- Shrief demonstrates how to simulate different cash flow scenarios using Excel’s

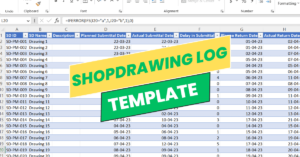

- Exporting and Sharing Data

- Explore tips for preparing your cash flow sheet for presentations or sharing with stakeholders.

- Learn how to use conditional formatting to highlight critical periods or trends.

Applying Cash Flow Techniques to Your Projects

Using insights from the videos, here’s how you can apply these techniques to your construction projects:

Step 1: Develop a Cash Flow Template

- Start with a basic structure, as shown in the first video. Include columns for revenue, expenses, and net flow over time.

- Use conditional formatting to highlight negative cash flow periods.

Step 2: Automate Calculations

- Apply Excel formulas to automate cumulative totals and real-time updates as project data changes.

Step 3: Visualize and Analyze

- Create S-curves and other visual tools to track project progress and identify trends.

- Perform scenario analysis to prepare for potential risks.

Step 4: Share with Stakeholders

- Regularly update your cash flow sheet and provide stakeholders with clear, concise visualizations to ensure transparency.

Additional Resources

For those interested in taking their cash flow management skills further:

- Explore more tutorials and tips on Shrief Elgendy’s YouTube Channel.

- Consider enrolling in the Power BI for Construction Projects course on Udemy to integrate advanced data visualization techniques into your cash flow management process.

Why Master Cash Flow Management in Construction Projects?

Effective cash flow management ensures:

- Timely completion of project milestones.

- Prevention of financial crises caused by delayed payments.

- Improved decision-making through data-driven insights.

By using Excel and applying techniques shared in these tutorials, construction professionals can enhance their cash flow tracking capabilities, contributing to smoother project execution and financial stability.

Conclusion

Cash flow management is an indispensable skill for construction project managers. With tools like Excel and guidance from experts such as Shrief Elgendy, managing project finances becomes more efficient and effective. By leveraging these resources, you can gain greater control over your projects, ensuring financial health and timely delivery.